Leveraging deep industry expertise and market insights, MuRong Technology introduces an innovative solution: the MuRong Self-Service Equipment System (MuRong SES).

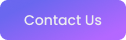

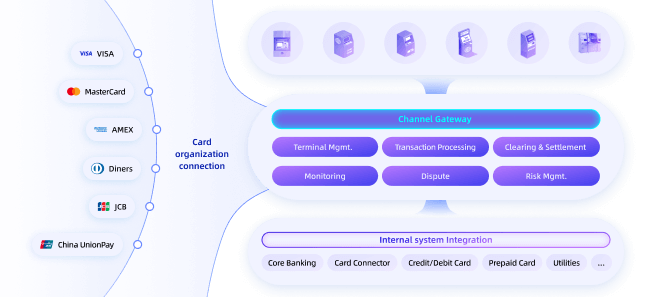

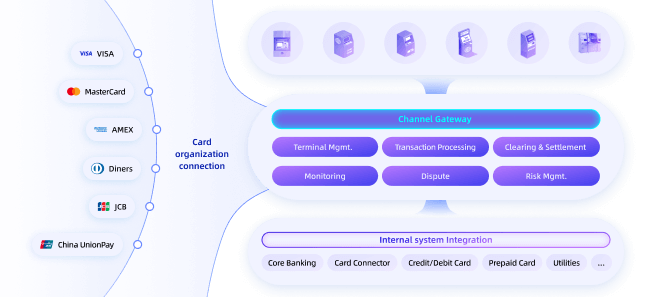

MuRong SES utilizes a distributed microservices architecture designed for high scalability, openness, and agile development, significantly reducing time-to-market for new functionalities. The system enables seamless integration with a broad range of self-service devices, including ATMs, cash deposit machines (CDMs), and cash recycling systems (CRS). This approach effectively addresses technical bottlenecks, allowing banks to transition smoothly from legacy technologies to advanced solutions. MuRong SES offers a comprehensive self-service equipment management solution, featuring core modules such as terminal management, transaction processing, risk control, dispute resolution, and channel gateway management. The platform supports centralized control of diverse self-service devices, enabling remote maintenance and real-time operational monitoring. It efficiently handles complex business processes, such as cross-border transactions and multi-currency exchanges, automates transaction dispute management, and provides rapid integration with mainstream payment channels and equipment from multiple vendors. Furthermore, MuRong SES employs a modular design, effectively catering to the diverse requirements of banks. This design significantly enhances service capabilities, elevates customer experience, and substantially improves overall operational efficiency.

Leveraging deep industry expertise and market insights, MuRong Technology introduces an innovative solution: the MuRong Self-Service Equipment System (MuRong SES).

MuRong SES utilizes a distributed microservices architecture designed for high scalability, openness, and agile development, significantly reducing time-to-market for new functionalities. The system enables seamless integration with a broad range of self-service devices, including ATMs, cash deposit machines (CDMs), and cash recycling systems (CRS). This approach effectively addresses technical bottlenecks, allowing banks to transition smoothly from legacy technologies to advanced solutions. MuRong SES offers a comprehensive self-service equipment management solution, featuring core modules such as terminal management, transaction processing, risk control, dispute resolution, and channel gateway management. The platform supports centralized control of diverse self-service devices, enabling remote maintenance and real-time operational monitoring. It efficiently handles complex business processes, uch as cross-border transactions and multi-currency exchanges, automates transaction dispute management, and provides rapid integration with mainstream payment channels and equipment from multiple vendors. Furthermore, MuRong SES employs a modular design, effectively catering to the diverse requirements of banks. This design significantly enhances service capabilities, elevates customer experience, and substantially improves overall operational efficiency.

why choose

MuRong SES ?

Cost Reduction

• Real-time remote operation and maintenance (O&M)

significantly reduce manual inspections, minimize downtime through

proactive fault analysis, and automatic repairs,

thereby lowering maintenance costs.

• Centralized multi-vendor device management minimizes labor demands

through a unified management platform.

Enhanced Transaction Security

• Integrated risk control engines provide dynamic monitoring capabilities, promptly identifying and preventing fraudulent activities and security breaches.

Superior User Experience

• Facilitates innovative transaction methods such as

QR code withdrawals, mobile appointment-based transactions,

and cardless services, streamlining operations and boosting user satisfaction.

• Combines intuitive voice interaction with visual interfaces,

enhancing usability particularly for elderly and special-needs customers.

why choose

MuRong SES ?

Cost Reduction

• Real-time remote operation and maintenance (O&M)

significantly reduce manual inspections, minimize downtime through

proactive fault analysis, and automatic repairs,

thereby lowering maintenance costs.

• Centralized multi-vendor device management minimizes labor demands

through a unified management platform.

Enhanced Transaction Security

• Integrated risk control engines provide dynamic monitoring capabilities, promptly identifying and preventing fraudulent activities and security breaches.

Superior User Experience

• Facilitates innovative transaction methods such as

QR code withdrawals, mobile appointment-based transactions,

and cardless services, streamlining operations and boosting user satisfaction.

• Combines intuitive voice interaction with visual interfaces,

enhancing usability particularly for elderly and special-needs customers.

Key features

of

MuRong SES

Unified Platform

Offers a centralized platform for unified management of transactions and operations, supporting rapid development and deployment of new service integrations.

Multi-Vendor Support

Incorporates pre-installed standard communication protocols, enabling swift onboarding and centralized management of equipment from major vendors.

Multi-Device Compatibility

• Supports diverse self-service equipment including ATMs, Cash Deposit Machines (CDMs), Cash Recycling Systems (CRSs), card dispensers, receipt printers, and more.

Flexible Product Configuration

Enables branch-specific customization such as tailored financial products and value-added services.

Agile Development

Utilizes standardized frameworks for streamlined customization, rapid testing, and iterative development, ensuring agile responsiveness to evolving business needs.

Key features

of

MuRong SES

Unified Platform

Offers a centralized platform for unified management of transactions and operations, supporting rapid development and deployment of new service integrations.

Multi-Vendor Support

Incorporates pre-installed standard communication protocols, enabling swift onboarding and centralized management of equipment from major vendors.

Multi-Device Compatibility

• Supports diverse self-service equipment including ATMs, Cash Deposit Machines (CDMs), Cash Recycling Systems (CRSs), card dispensers, receipt printers, and more.

Flexible Product Configuration

Enables branch-specific customization such as tailored financial products and value-added services.

Agile Development

Utilizes standardized frameworks for streamlined customization, rapid testing, and iterative development, ensuring agile responsiveness to evolving business needs.

Benefits

Benefits

Rapid Implementation

& Optimal ROI

Rapid Implementation & Optimal ROI

MuRong SES supports multiple

international standard protocols,

facilitating swift deployment and

seamless integration with existing

systems, equipment, and business

processes. This ensures smooth

transitions from legacy systems,

significantly reduces

implementation costs, and

maximizes return on investment

(ROI).

Operational Efficiency Enhancement

Operational Efficiency Enhancement

Provides a centralized management platform with unified control and real-time monitoring capabilities. MuRong SES efficiently manages operator permissions, device parameters, and transaction workflows using lightweight agent technology for cross-platform monitoring. It generates multidimensional analytical reports to enhance operational efficiency, strengthen risk control, and support informed decision-making.

Innovation-Driven Business Growth

Innovation-Driven Business Growth

MuRong SES features exceptional scalability and openness, enabling rapid adoption of cutting-edge technologies such as AI and biometrics. The system's flexible performance scaling supports ongoing business growth. Additionally, by offering differentiated services like QR code withdrawals, phone-based appointments, and intelligent customer service, MuRong SES empowers banks to swiftly launch innovative products, seize new market opportunities, and drive sustainable revenue growth.

Benefits

Benefits

Rapid Implementation

& Optimal ROI

Rapid Implementation & Optimal ROI

MuRong SES supports multiple

international standard protocols,

facilitating swift deployment and

seamless integration with existing

systems, equipment, and business

processes. This ensures smooth

transitions from legacy systems,

significantly reduces

implementation costs, and

maximizes return on investment

(ROI).

Operational Efficiency Enhancement

Operational Efficiency Enhancement

Provides a centralized management platform with unified control and real- time monitoring capabilities. MuRong SES efficiently manages operator permissions, device parameters, and transaction workflows using lightweight agent technology for cross-platform monitoring. It generates multidimensional analytical reports to enhance operational efficiency, strengthen risk control, and support informed decision-making.

Innovation-Driven Business Growth

Innovation-Driven Business Growth

MuRong SES features exceptional scalability and openness, enabling rapid adoption of cutting-edge technologies such as AI and biometrics. The system's flexible performance scaling supports ongoing business growth. Additionally, by offering differentiated services like QR code withdrawals, phone-based appointments, and intelligent customer service, MuRong SES empowers banks to swiftly launch innovative products, seize new market opportunities, and drive sustainable revenue growth.